Whether you use QuickBooks Online or QuickBooks Desktop, there are transactions that are non-posting and transactions that are posting. But what are these non-posting and posting transactions and what do they mean? Let’s dig into these important and sometimes misunderstood transactions.

What are Posting Transactions?

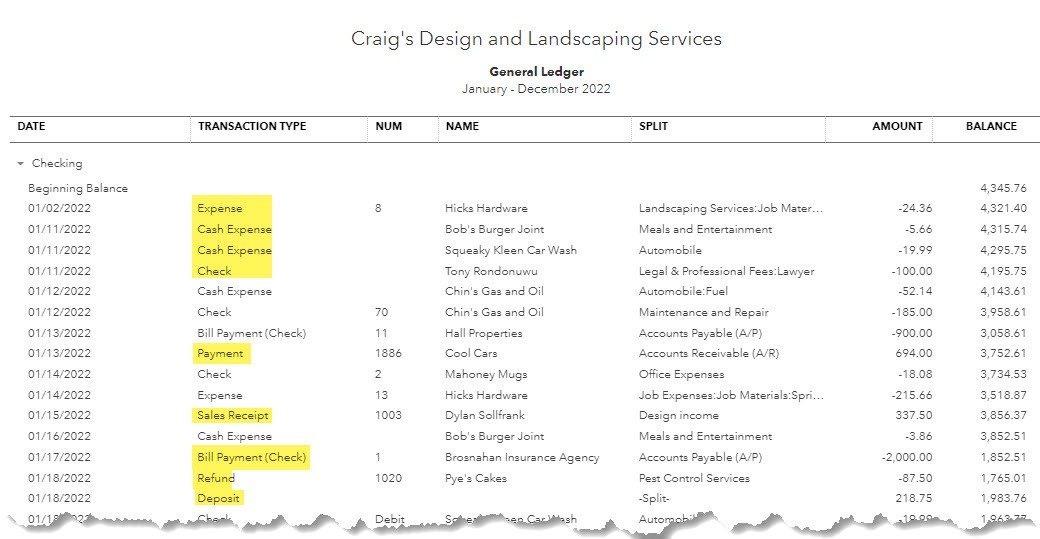

When you record a business transaction, such as an expense or a sale, the transaction is recorded into the general ledger. The general ledger displays the balances on the Profit and Loss and the Balance Sheet.

Posting transactions happens when you enter a check, a credit card charge, or enter a bill from a supplier. Invoicing a client and paying your employees are also forms of posting transactions. These posting transactions are easy to understand because these are what we see in the reports we pull from QuickBooks. What about non-posting transactions?

What are non-posting transactions in QuickBooks?

Non-Posting transactions are transactions that are planned activities but are not yet final. What does this mean? For Example, a purchase order with inventory that you plan to receive and get a bill for, is a non-posting transaction. An estimate for a client for future billings is also a non-posting transaction.

Non-posting transactions will not affect the balances to the general ledger or even the balances to a vendor or customer account.

Other forms of non-posting transactions are also timecards, delayed charges for customers, and sales orders (in desktop).

Understanding the differences in these transactions will help you understand what information you are seeing when you pull up reports in QuickBooks.

To learn more about Bookkeeping Basics, check out my YouTube video Back to the Basics! An Intro to QuickBooks.